Borrowing B2C pricing methods doesn’t work for B2B—here’s what does

My previous blog explained why 90% of value-based pricing and selling in B2B software is a hoax. The problem is that widely used methods borrowed from B2C markets don’t work in B2B, where products and usage are more complicated, making value harder to compare and estimate.

Estimating buyer perception of value and willingness to pay is also difficult. In B2B, value perception is strongly affected by organizational software experiences. Also, differential value is often concentrated in innovations prospective buyers haven’t yet experienced. Such innovations might enable currently unimaginable operational improvements. Hence buyers can’t tell you in a survey what they’d be willing to pay for them.

A B2C pricing approach isn’t advantageous for B2B buyers. List pricing and discretionary discounting untethered to real product value can lead to a proliferation of one-off deals. Customers buying the same set of products and services at the same volume may be charged wildly different prices. Even so, sellers often get significantly less than their software’s true value. These outcomes are the opposite of our goals in Market Fairness Pricing.

So if B2C methods don’t work for B2B software, what does?

There are principles and software you can utilize to craft a successful pricing strategy. Here are our top three principles for a successful value-based pricing model and selling:

1. Look beyond value perception to how customers actually derive value from usage

We can’t rely on what customers say to estimate software value. We need to understand what they do, including purchases and software usage. While customer data from purchase transactions is less abundant than in B2C, usage data can be plentiful, detailed and revealing. When properly married with billing transaction data it becomes even more powerful.

Combining the qualitative and quantitative data inputs from research, essential insights and nuances that wouldn’t surface through other methods emerge. For instance, when we analyzed quantitative and qualitative data for a provider of aerial imagery and location software, we found that some customers were consuming remarkably high quantities of the aerial images. It turns out these were utilities that were combining as many as ten years of aerial photos with historical hurricane data. The goal was to predict where current storms might take down power lines so field crews could be dispatched to likely areas before they got hit.

For the software provider, however, archived aerial images had been a “shadow feature,” largely overlooked in product management and pricing. Yet once it became clear that the archive was of significant value to some customers, we identified other customers who might benefit from using the software similarly. Here was an opportunity to improve their pricing method by pulling the feature from the shadows and packaging it with supporting functionality as an add-on product. This was a customer-centric way of expanding the buyer-seller relationship while ensuring the provider was paid fairly for the software’s value.

Still, I’d argue that the most successful value-based pricing strategy in B2B software is more than customer-centric. It melds quantitative and qualitative customer inputs with the provider’s perspective on value.

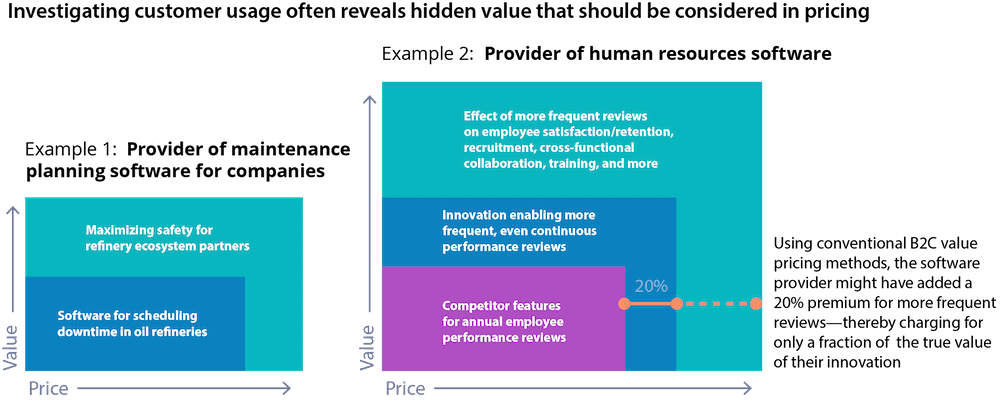

For instance, in the previous blog I mentioned a provider of HR software that innovated on the standard annual performance review feature by enabling user organizations to choose any review frequency—semi-annual, quarterly, even continuous. At that time, most of the company’s customers hadn’t considered how more frequent reviews could affect their operations. But the provider saw business value in the potential for improving employee satisfaction and retention, recruitment, cross-functional collaboration, resource availability and training—and priced the software accordingly. Had they followed B2C value pricing methods, comparing competitor features and adding a differential (maybe 20% for more frequent reviews), they would have gotten a fraction of the true value of their innovation.

Similarly, a provider of dental practice management software had been licensing its product by number of user organization locations. After analyzing location-based customer data more deeply, we recommended they move to a usage-based model that better addressed important nuances in how their customers derive value. While there was initially some push-back from the sales team—customer locations with certain usage characteristics had to pay more—the company is beginning the transition and already gaining insights into their customers’ willingness to pay based on actual behavior.

Another case in point: One of our clients had built a value proposition around its software’s ability to coordinate scheduled downtime in oil refineries. We discovered that while downtime was indeed being minimized, another benefit was maximizing safety for the refineries’ ecosystems of partners. This insight was crucial in monetizing higher value-added features at premium prices and eventually evolved into new mobile products and services that today drive additional revenue streams for the company.

2. Segment, package, price and sell based on similarities in value derivation

My observation is that many companies don’t fully benefit from what they learn in conversations with customers. Typically, software usage and derived value insights will drive efforts to fill gaps in product roadmaps or support services. Less frequently, companies realize opportunities for more innovative packaging and pricing. Even more rarely, insights become triggers for re-thinking customer mix and sales strategy in ways that produce substantial performance gains.

One of our clients, for instance, had used traditional marketing techniques to decide that their “ideal customers” were organizations whose number of employees was below a certain threshold. Anything larger, they assumed, would be operationally too complex for a good fit with their software.

But when we studied customer usage, we found some larger organizations with decentralized operations loved the software and were very engaged. They were using and deriving value from it in much the same way as smaller companies. We suggested that complexity should be redefined as a function of operational characteristics rather than the number of employees. That changed the provider’s ideal customer profile, segmentation and lead scoring—creating new momentum that enabled them to beat sales forecasts month over month for the next 18 months. Today the company is poised to go public.

3. From this base, gradually test willingness to pay as you deliver increasing value

In my previous blog, I mentioned that sometimes a B2C value-based pricing strategy is so focused on figuring out what buyers are willing to pay that they’re devolving into what this buyer is willing to pay now. In my opinion, this dynamic pricing is not advantageous for B2B software buyers or sellers. It only adds to market conditions that can sometimes be as chaotic and risky as a “wild, wild West” frontier town. And in an environment like that, where nobody can trust, nobody can ever really win.

There’s a better way to discover willingness to pay for B2B software. We recommend performing a series of controlled incremental price changes to better understand and push the boundaries of willingness to pay for customer classes with similar usage and derived value characteristics. This is an empirical, reliable, risk-mitigating method of conducting demand elasticity analysis, firmly rooted in how customers behave (not just what they say).

In addition, this method helps you harmonize pricing with the rate of new value creation from your product roadmap. In B2B software, especially if subscription-based, customer value perception contains a futures element. Customers expect a stream of increasing value. So another way to think about this is you’re taking pricing validation steps in a journey that always keeps you on the safe side of the razor’s edge of being paid fairly for your software’s value.

As you move forward, keep your pricing anchored in reality by continuing to analyze purchase and usage data. Invest in tools (like our LevelSetter) that help you model and simulate the impacts of pricing changes, and track them at the line-item level during rollouts.

This type of tool can also help you better understand your customer mix—including how it changes over time—and your demand curve. You’ll be able to answer questions like “Are we seeing the first signs of price resistance?” And “Do we need to be spending this much to achieve our target growth rate?” And the most important question of all: “What is our optimal price point for maximum revenues and profits?”

Stay tuned for more tips on improving a value-based pricing model

Follow the tips above to implement value-based pricing successfully. My next blog will show you how to improve your value-based pricing strategy by helping sales teams sell on value. In the meantime, if you have questions about B2B software pricing, please get in touch with me: chrismele@softwarepricing.com.