Both buyers and sellers are shooting themselves in the foot

As software design and development has evolved into a highly planned and disciplined process, the pricing of software has largely remained as chaotic, opportunistic and risky as a frontier town. In an environment where nobody can trust, nobody can ever really win. The surprising lack of pricing sophistication in many software companies harkens back to the days of the Wild West, where frontier towns were often established impulsively and followed few rules.

In today’s hi-tech version of frontier town, software companies often price by copying competitors or based on empirical knowledge and historical data that doesn’t reflect how current customers value and use their software. The industry is also rife with loosely defined, overly complicated pricing models that sales teams don’t understand and can’t defend.

But even businesses with adequate pricing models often ride roughshod over them when it comes to execution. Many companies’ sales books are predominantly made up of discretionary, random and bespoke deals or custom packages—even for everyday sales configurations that shouldn’t require special treatment.

Worse than this is the frontier town mentality such practices have fostered: wariness, suspicion and trying to shoot the other guys before they shoot you. It’s no wonder B2B buyers are increasingly defensive and aggressive, since the key question in software pricing seems to have slipped from “What will the market bear?” to “What will this customer bear?”

Frequently, customers purchasing the same set of products or services pay unjustifiably different prices—a complete reversal of the principle of market fairness. When I joined Philip Ideson for his Art of Procurement podcast, he mentioned seeing price differences of as much as 10x for the same software product sold to different buyers, and I’ve personally seen even more.

Callouts:

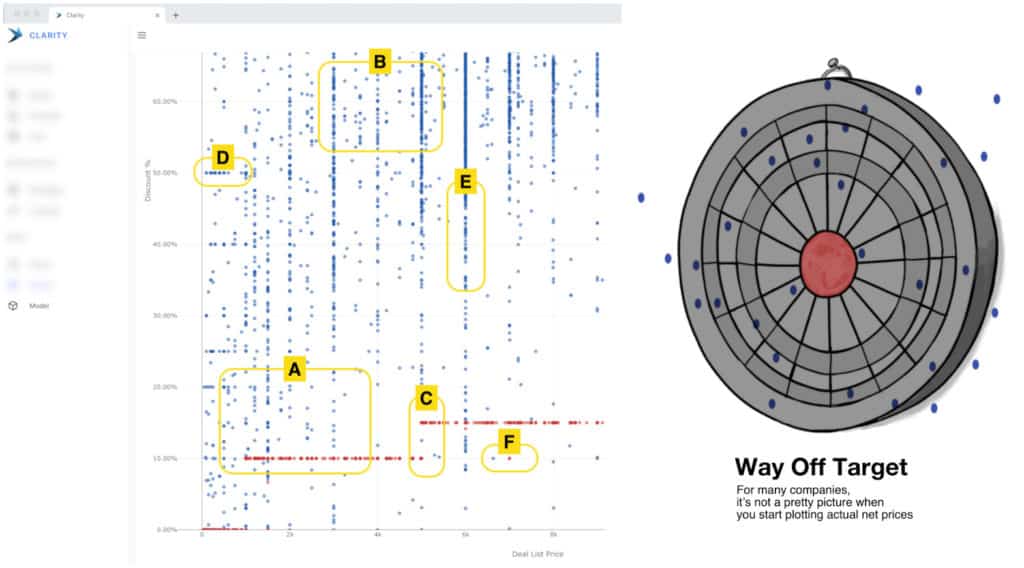

A. Red dots are where the deal should have been priced. Blue dots are where the deal landed after it went through the sales team or partner channel.

B. Messiness between blue dots indicates odd-ball partial-term transactions, which can work against buyers and sellers.

C. Incorrect tiered pricing calculations show systemic issues in a company’s pricing structure, opening up loopholes for buyers to take advantage of.

D. Clustered deals (darker blue concentrations) around manager approval thresholds indicate inefficient discretionary discount behaviors.

E. SKU “pipes” (blue vertically stacked dots) show same deal configurations being sold at different net prices. Likely culprits are poorly differentiated packaging, ineffective licensing metric(s) and/or internal processes/tools that fail to properly control ad-hoc discounting.

F. Multiple “valid” structured price points (stacked red dots) for the same configuration show systemic issues in how multi-product buys are priced internally.

Buyers aren’t the only victims

In many cases, the frontier environment also works to the disadvantage of sellers. Dysfunctional conditions on both sides of deals ultimately rob sellers of some of the value they should be earning—both in sales commissions and in the company’s rightful compensation for intellectual property and development investments.

Here are some of the biggest hits sellers are taking:

Long sales cycles.

Distrustful buyers may try to negotiate every aspect of purchases, squeeze sellers through RFPs and other procurement tactics or wait until the last hour of Q4 to make deals.

Wide margin swings.

Lack of adherence to pricing models and too much discretionary discounting expands margin ranges (60 pt. swings are more common than you might think). Buyers discover this and try to swing deals their way by gaming the system (see bullet above).

Inaccurate revenue forecasts.

It can be impossible for sales leadership to predict revenues when they never know at what net price certain deals in the pipeline will land. It’s also quite common for software executives to underestimate the varieties and amounts of discounts flowing through their company’s book of business.

Overly complicated sales operations.

Inside the company’s quoting and billing systems, SKUs are created on the fly for different versions of the same product, or for bundles of products with lower list prices that mask discounts. These new SKUs can quickly dominate the quote line items for a sales team, resulting in list price erosion. This quickly creates a layer of obfuscation for finance and accounting. It may actually become impossible for the executive team to understand the truth on the ground.

Revenue leakage.

Buyers who discover your wide-ranging net prices will use them as data points to argue for the maximum discount. Too much of that, and your revenue projections become unreliable. Other sources of leakage are poorly constructed pricing models that don’t provide a systematic, strategic framework for using structured incentives to expand and accelerate deals.

Poor packaging/pricing may also leak revenue by not covering edge and corner use cases, which gives customers the opportunity to negotiate around features that won’t be used by their employees, and therefore arguing down price.

Reduced marketplace agility.

When pricing models are unstructured and ambiguous, you’d think sellers would have more maneuverability—but often, it’s the opposite. Products are, of course, developed over time and priced when brought to market. But without a strong underlying rationale and framework for monetization, pricing can end up wildly out of whack. The relative prices of products don’t make sense to prospects, creating a disincentive for multiple purchases. Sales teams have less agility to put together complete solutions. Buyers who perceive prices as unfair apply more downward pressure. Salespeople spend more time defending price points, leaving less time to engage with clients in creative problem-solving, solution-finding mode.

Increasing procurement involvement and RFPs.

To protect themselves from being roped into a bad deal, more and more buyers are by choice or mandate bringing in procurement specialists–many of whom are now armed with sophisticated competitive intelligence resources. When this happens, tightly constrained boundaries around deals may transform collaborative partnership relationships into vendor relationships. Now everyone sticks to the letter of the agreement, and any unforeseen needs trigger change requests rather than “extra mile” assistance. Also, many RFP processes are now purposefully opaque, making it difficult for sellers to understand user needs and decision criteria. Requests may be constructed in ways that limit the range of responses from sellers and thus the exposure of buyers to their full range of options. As a result, buyer risk increases while opportunities for achieving competitive advantage through innovative software decrease—the opposite of the RFP’s purpose.

Low customer lifetime value.

Bespoke terms and conditions written into salesforce notes can become permanent fixtures of ongoing relationships—and friction points for renewals and other future deals. These snags, which create headaches for customer relationship management teams, may be largely invisible to sales management, especially when tucked into numerous contracts in large company deal flows.

Another obstacle to expanding existing relationships is prices that don’t align with the value customers derive as they increase usage. The price has to make sense and be fair at 100 units and at 10,000, as well as for different categories of users. Also, in a low-trust environment, buyers will often constrain the initial deal to a less-than-ideal configuration. Maybe they’ll purchase only a piece of the functionality they need or restrict deployment to just a fraction of the users who could potentially benefit. As a result, despite some performance gains, the buyer organization never fully experiences the software’s value. This curtailed experience can hamper seller land-and-expand strategies and/or increase customer churn, both of which lower CLTV.

Lack of reliable data for iteration and improvement.

Without a structured approach centered around the principle of market fairness, the “rules” or “art” of dealmaking tend to reside in the brains of one or more sales professionals. That approach doesn’t lend itself to organizational consistency or skills transfer and growth. Nor is there enough information being gathered in a structured way for reliable analysis of what’s working/not working and ongoing refinement of the pricing model.

Is your software company avoiding this fundamental problem?

These and many more issues point to a fundamental problem with brand positioning and customer trust. Are you positioning your brand as having a customer-centric culture? If so, put yourself in the shoes of your sales team and imagine how they would respond to this question from a prospective customer: “Why did you send me a quote that is X% more than someone I know personally who just bought the same thing from you last week?”

If you’ve ever been in sales, you’ll recognize that at this point seller and company credibility—and trust—have been irrevocably lost. Even worse, this prospect will tell the story again and again to colleagues and industry acquaintances, spreading distrust that could taint other sales opportunities.

BambooHR reflects on the solid foundation they created using our Market Fairness Pricing approach, just prior to their meteoric growth.

So how do we fix this?

In my next post, I’ll talk about bringing software pricing into the modern era with Market Fairness Pricing geared to today’s complex, dynamic markets. In subsequent posts, I’ll revisit in more depth some of the specific problems surveyed above and discuss how to solve them using a systematic, data-driven, programmatic approach within a Market Fairness Pricing framework.