Market Fairness Pricing works better and increases value for both software buyers and sellers

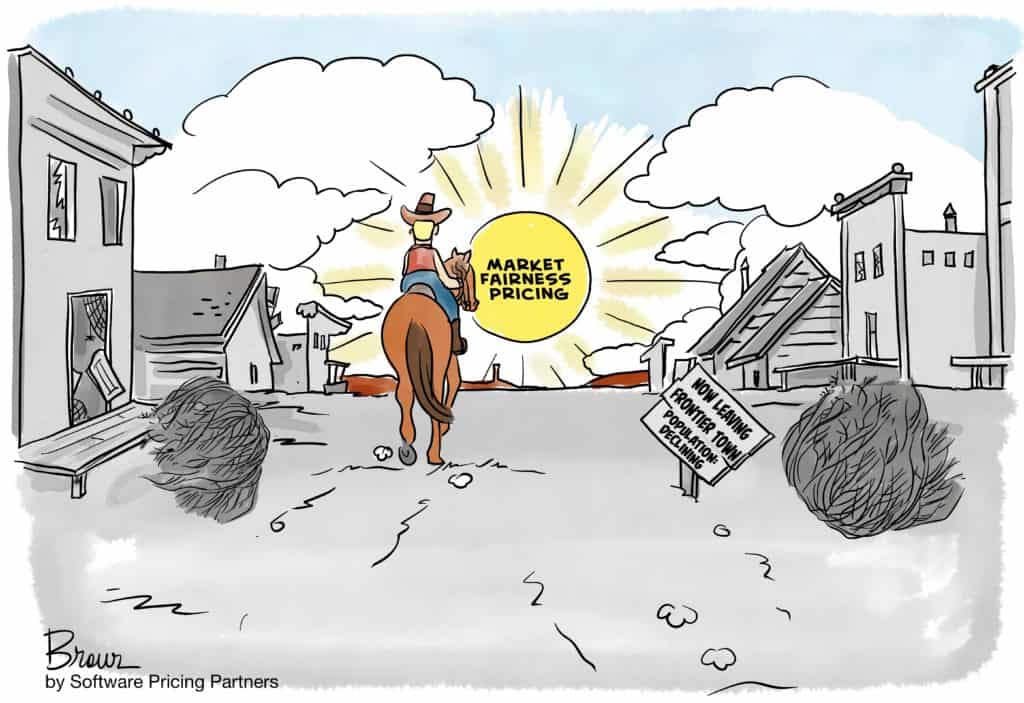

As I discussed in a recent post titled Software pricing is the Wild Wild West—both buyers and sellers are shooting themselves in the foot, the way many companies monetize their software is far less sophisticated and disciplined than the way they develop it.

Mired in frontier town methods and mentality, many B2B software sellers are delivering less value than they could to increasingly distrustful buyers—who sometimes pay wildly different prices for the same set of products and services. Sellers are also getting less than they could from many of these transactions, since frontier town practices frequently undercut revenues, prolong sales cycles and dilute customer lifetime value.

Adopting Market Fairness Pricing as one of your SaaS pricing models

In my view, it’s time for software providers to leave frontier town pricing behind and adopt more strategic, systematic, data-driven software pricing methods. And these modern techniques should be layered over the bedrock of a fundamental commitment to the principle of market fairness: Buyers who purchase the same set of products and services should pay the same price.

At Software Pricing Partners, we call this approach Market Fairness Pricing and advocate it not only for ethical reasons but pure business pragmatism. Market Fairness Pricing simply works a whole lot better for both software buyers and sellers.

The benefits of a Market Fairness Pricing Strategy

In subsequent blogs, I’ll explain in detail how Market Fairness Pricing is advantageous on both sides of software deals. For now, here are a few of the top benefits for sellers:

- Accelerates deal velocity. A simplified approach to software monetization removes pricing confusion and other sources of friction that slow sales processes. Pricing transparency increases trust, so buyers are less likely to negotiate every aspect of deals or try to game the process.

- Strengthens revenues and margins across the entire customer base. With equitable pricing for all, buyers aren’t looking for evidence of deeply discounted deals and insisting you match these data points. You’re no longer at risk of seeing your entire go-forward pipeline discounted by the maximum margin swing on a sale. Also, higher trust means buyers are less likely to artificially constrain the size of the initial deal as a risk mitigation strategy. Improved transparency helps them better understand their cost structure for a current software purchase as well as forecast costs for wider deployment and additional use cases, encouraging more rapid and fluid project scaling.

- Boosts competitive advantage and win rate. When buyers can understand your pricing rationale, you have a strong competitive advantage. One of our clients, for example, was the only one among a shortlist of sellers able to quickly explain the derivation and execution of their pricing model—and they walked with a $4.5M ARR deal. Another client reports they’re winning “at least every other deal” in a vibrant new SMB channel opened from scratch. In just one quarter they already had a “very strong pipeline worth millions of dollars,” which the executive VP of sales attributes to pricing strategy.

- Deepens customer lifetime value. This more systematic approach to pricing eliminates hidden bombs that often lurk in contracts for discretionary deals and can disrupt renewals. Land and expand strategies actually expand because pricing aligns with the value customers derive as they increase usage. The price makes sense at 100 units or 10,000 units, as well as for different categories of users.

I won’t go into further seller benefits here, but Market Fairness Pricing also sharpens the accuracy of revenue forecasts, improves marketplace agility, facilitates interactions with procurement specialists and provides more reliable data for iteration and improvement of software monetization strategies.

Clearly, there are plenty of good reasons to “Get out of Dodge!” and move toward a new pricing horizon. First step: Know where you’re heading.

What exactly is Market Fairness Pricing?

It’s a systematic, proven method of implementing the market fairness principle (customers buying the same thing pay the same amount) in a manner that lifts profits along with customer trust, satisfaction and engagement.

This method, which emphasizes pricing integrity and transparency, is the opposite of what some software companies are doing as they slide down the slippery slope of “willingness to pay” pricing. With that approach, net prices can fluctuate on the same product just because a customer is in a different industry segment (even though the value they experience from the software is similar).

The goal is not to take customers for the maximum amount, untethered to value. Nor are we trying to control discounting by aligning today’s discretionary discount with yesterday’s discretionary discount (this inadvertently exacerbates the problem).

Instead, we use quantitative and qualitative data to fully understand how customers derive value from the software. We activate new skillsets inside product management so our clients can better identify customers that derive unique value and address their needs through advanced packaging techniques. We also use ethical competitive intelligence to reveal the real prices being paid for competitive solutions.

The goal is to monetize software precisely, strategically and in a manner that has the best interests of customers at heart. It’s an approach that enables companies to walk the talk of customer centricity.

Market Fairness Pricing is based on a comprehensive software monetization framework comprising:

- Value-aligned licensing. This foundation for monetization defines the metric by which customers will pay you as well as their usage and deployment rights. In Market Fairness Pricing, licensing metrics align with how customers perceive and derive value from the software. Payment and contractual terms should be unambiguous and consistent with customers’ business models, supporting their need for predictability.

- Targeted packaging. Packaging is the way you connect different classes of customers with the combination of software features and services that best matches their needs. In Market Fairness Pricing, packaging reduces sales friction and accelerates deal velocity. You create strategic package options aimed at specific classes of customers who extract value in similar ways. You resist overly complicated packaging structures that encourage bespoke deals and decelerate deal flow. And you ensure natural upgrade/upsell migration when customers need more functionality.

- Optimized pricing model. The best pricing models are programmatic, using data and formulas to remove ambiguity. In Market Fairness Pricing, models reflect how customers gain value from the product, cover edge and corner cases, work for large and small organizations, address a full range of ordering scenarios, and continue to make sense to customers as they expand deployments. Make your price structure simple, unambiguous and easily understandable by buyers and salespeople. Avoid overly complicated tiered pricing, which invites gaming and exploitation.

- Behavior-based discounting. A key component of an optimized pricing model is a discount schedule of structured incentives encouraging desired purchasing behaviors. (Unstructured discounting is a leading contributor to software revenue and profit shrinkage, and lower-than-expected company valuations.) In Market Fairness Pricing, you create a standardized schedule of earned—never given—discounts, adhere to them and monitor transaction data to ensure adherence.

- Continuous data analysis, iteration and improvement. Market Fairness Pricing is a live method, adapting to changing customer needs and competitor actions. It depends on fresh inflows of transaction and usage based pricing data. With data-driven insights, you can further optimize your pricing model. You can identify customer segments with growth potential, see which software elements are gaining or losing traction in the marketplace and steer product development roadmaps. You can meld roadmap capabilities into existing packaging in ways that encourage expansion, up-sells and cross-sells.

BambooHR reflects on the solid foundation they created using our Market Fairness Pricing approach, just prior to their meteoric growth.

Stay tuned for more articles on the benfits of Market Fairness Pricing

That’s an overview of how Market Fairness Pricing works and why it’s advantageous for both buyers and sellers. In my next couple of posts, I’ll dive deeper into benefits such as accelerated deal velocity and look at how this straightforward, transparent approach to pricing can help you stand out in a field of competitors.