Salespeople in the B2B software world are often prodded to “sell on value.” In most cases—I’ll estimate 90%—they’re being asked to do the impossible.

The problem is not just that poorly conceived pricing models undercut value. (In the words of one frustrated salesperson: “How am I supposed to sell on value when I have to discount over 70% to make the sale?!)

It’s also that value-based pricing techniques borrowed from B2C markets don’t work in B2B software.

Let’s assume for a moment there actually is a smart pricing model with a discounting framework that would enable salespeople to clearly discuss and defend software value in conversations with buyers. Still, the starting point for these conversations is a set of list prices that have probably been arrived at through an erroneous process. I’ll explain how to do value-based pricing right for B2B software, but first, a quick review of this basic pricing concept.

Value-based pricing basics

Value-based pricing strategies set price points based on the seller’s estimate of the buyer’s perception of product/service value. Compared to a standard cost + markup approach, this type of pricing can be highly influenced by market conditions, competitor actions and buyer emotions.

For instance, one approach to a value-based pricing strategy tries to break down the relative value of various product features. You do a feature-by-feature comparison with competitive offerings and set your price based on differentiation.

Another approach tries to figure out what buyers are willing to pay. It’s affected by product scarcity (high demand/low availability increases perceived value) and by factors such as prestige and exclusivity.

This approach often devolves from what buyers are willing to pay to what this buyer is willing to pay at this moment. Dynamic value-based pricing driven by algorithms is why some Bruce Springsteen concert tickets recently shot up to $5,000+. And that’s without the involvement of scalpers (unless, like some angry fans, you put Ticketmaster and the Boss himself in that category).

Three reasons B2C value-based pricing techniques don’t work for B2B software

Here’s why the vast majority of value-based pricing in B2B software can’t be trusted and isn’t working to the advantage of either buyers or sellers:

1. There aren’t enough common reference points for known categories.

To estimate the buyer’s perception of value with statistical reliability, you need plenty of purchase data.

In B2C markets, we have that. There are many well-known product categories, such as flat-screen TVs, recliners and hair gels. Each of these categories has data from an abundance of purchase transactions. Products also tend to have well-understood, comparable features, such as an HDMI slot on a TV. So there are plenty of reference points we can use to look outward to the market when estimating differentiated value.

Not so in B2B software. First, the number of product features and variables is much bigger. This creates a “curse of dimensionality” problem (the number of sampled data points required for accurate analysis grows exponentially with the number of input variables). As a result, we would need an enormous number of transactions to yield enough data for estimating value perception using B2C techniques.

That’s why pricing consultants who insist on taking the B2C approach often try to supplement data with surveys. But what respondents say about value and how much they’d be willing to pay for it is notoriously unreliable, often having little to do with actual purchasing behavior. Effective B2B value estimation requires more sophisticated, revealing methods of capturing quantitative and qualitative inputs from buyers and melding them with the software provider’s own perspective on value.

A second challenge for estimating B2B software value is that we can’t always accurately compare features within known product categories.

Let’s say, as an example, several providers have a feature they call a “virtual HDMI slot.” All of them take in audiovisual data and transmit it to a downstream system, but beyond that, what the software does may be quite different. One company might incorporate metadata to enrich the audiovisual payload and enable additional downstream functions. Another might include something that improves the scalability of the feature.

Or think about a software product where all competing providers say they have a “call intelligence module.” This feature may be built on different technologies, have different methodologies underlying how it works and have very different implications for the user organization’s workflow. There’s no standard definition of that intellectual property (IP) component, much less of the software’s dozens of other IP components. (When working with clients, we typically uncover 50 to 100 value drivers, each of which ties back to a unique set of key features and/or services.)

Because software companies can create whatever they want and call it whatever they want, it is nearly impossible to assess differentiated value by looking outward at market trends, buyer behavior and competitors’ pricing.

2. Software value is about value extraction through usage—and in B2B that’s complicated.

There are only so many ways you can use a TV. There’s a limit to the types of problems you can solve with it. But that’s not true of most software. B2B software, in particular, can have enormous operational, cost and revenue ramifications for buyers depending on how they use it to extract value for their organizations and create value for their customers.

To gain maximum advantage from the software, it’s therefore not unusual for organizations, or individual groups of users within them, to make significant changes to their workflows and business processes. On the other hand, the ease with which software can be configured to support the buyer’s current operations or to fit the different ways user groups operate can also be a significant value differentiator.

An upfront survey could never capture most of these usage complexities and variables. And if a survey did try to dig for such insights, many respondents would misunderstand or skip over questions accompanied by lengthy explanations or requiring extensive thought.

Yet insights into software usage are critical, as they are potent clues for designing effective value-based pricing models and performing segmentation, packaging and other aspects of software monetization. Often a usage-based approach will lead in a different direction from traditional segmentation based on demographics, SIC codes and marketing personas.

For instance, would you be surprised to learn that wedding planners and equipment companies could use the same software? Working with a provider of equipment rental software, we discovered commonalities, which led us to recommend simplified packaging (the same base software plus tailored sets of add-ons). Another case in point: For a provider of HR software, we found the key to value-based pricing was if the buyer organization was going to use the product in centralized or decentralized operations.

Before moving on, I should point out that closely related to usage are potential differentiators around software implementation and other services. While these may come into play in B2C (mostly around convenience and ease), they are again far more complex in B2B. Potential value differentiators might include the provider’s domain knowledge and the degree to which that expertise has been baked into templates and other ready-to-use software features. There may be added value in the range and flexibility of deployment options, the quality of training programs, how quickly the software provider can transfer technical knowledge to user organizations, and how smoothly the software melds with DevOps and other IT functions. These are difficult to compare quantitatively but must be considered in value-based price setting.

3. Willingness to pay is inestimable because software innovates what isn’t—yet.

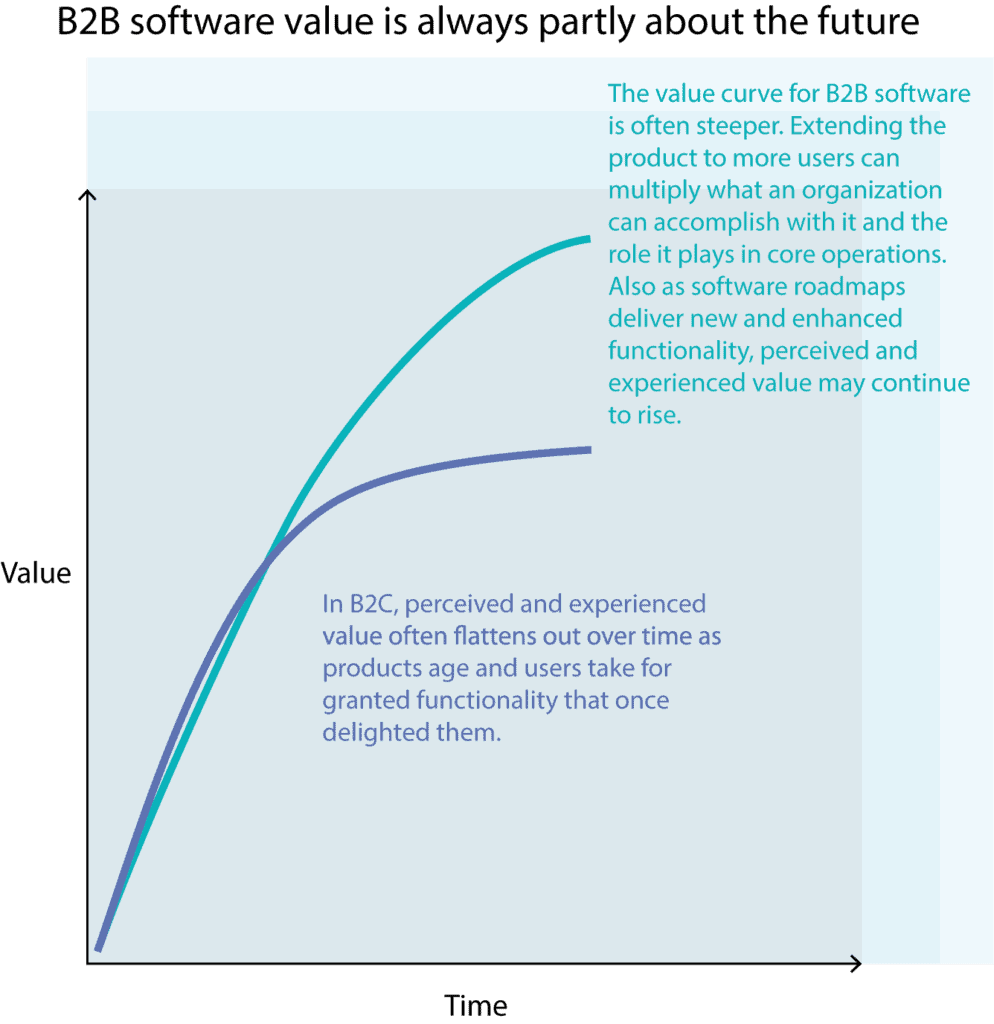

Another reason it’s difficult to estimate comparative value is that software is always pushing into the future. (Surveys, conversely, are performed at a moment in time and quickly out of date.)

In fact, differential value is often concentrated in capabilities prospective buyers can’t even imagine. Hence they can’t tell you what they’d be willing to pay for it.

Part of this forward momentum comes from software providers. They find creative ways to solve today’s problems. Top performers also conceive products and services not just for where customers currently are, but for where they anticipate them going.

Part of the momentum also comes from buyer organizations’ experiences. Usage often leads to disruptions in work processes that bring unpredicted benefits.

Here’s a case that demonstrates this dual provider/user futures dynamic.

One of our clients, a human resources software provider, innovated a capability for continuous performance reviews. In a market where the annual performance review was the norm, few buyers could fathom the far-reaching changes this shift in cadence would enable.

But the software provider realized that a continuous review capability could help organizations solve critical operational problems. Benefits might include improving recruitment, cross-functional collaboration, resource availability and training.

The provider could have followed traditional B2C value-based pricing methods, comparing competitor features and adding a differential (maybe 20% for increasing review frequency from once a year to quarterly). But they would have received a fraction of the true value of their innovation.

Instead, melding quantitative and qualitative analyses with its own perspective on value, the provider decided to set a higher price. The company prepared its salesforce to explain and defend this value. The product sold well—and, with usage, buyer organizations experienced the value they paid for and more.

In this case, unpredicted value emerging from software usage included better company culture and higher employee retention. Employees had generally hated periodic performance reviews. As the organization leveraged the software to evolve toward continuous reviews, employees found the feedback process less frictional and more helpful. Morale, motivation and organizational loyalty rose.

In truth, futures are almost always a big part of B2B software value. One of the things your customers are buying is your roadmap of innovation. That doesn’t happen to the same extent in B2C. Sure, you may have chosen to drive a BMW and be so satisfied with the experience that you expect to continue being a customer for the foreseeable future. But you can easily change your mind and buy a Tesla without having to make significant changes in your driving habits.

There’s a better way to do value-based pricing and selling for B2B software

In my next blog, I answer the question: If B2C methods of estimating and charging for value don’t work for B2B software, what does? We’ll also look at five principles of value-based monetization and what has to happen at the intersection between pricing and selling.

Stay tuned… and, in the meantime, if you have questions about B2B software pricing, feel free to contact me: chrismele@softwarepricing.com.