How to close software deals without trying too hard

What’s the best way to close a SaaS sale or other B2B software deal? Is your B2B pricing strategy helping or hurting you?

The most frequently recommended sale closing methods include:

- Assumptive close. Talk like it’s already a done deal.

- Scale/thermometer close. Ask buyers where they’re at on a scale from 1 to 10 and what you can do to move the number up.

- Takeaway close. Suggest removing features from the deal or even stepping back if they’re not ready to close—no one likes seeing their choices diminish.

- Objection close. Ask what is preventing them from doing the deal right now, and eliminate it.

- Now or never close. Offer an additional inducement available for only a limited time.

There are dozens of other recommended sales techniques you can read about online and try out on your prospects. My advice: Don’t do it.

A common misconception in sales is that it’s all about THE CLOSE. New sales team members are told to ask for the order and employ one of these tried-and-true sales techniques to make it happen.

I question this assumption based on my experience and observation in B2B software markets. In fact, I contend that by refusing to overthink closing, you’ll close deals with less effort, usually in less time.

The key is right pricing your B2B software. With an optimized pricing model (part of an integrated monetization strategy), your sales team can use more organic means to achieve what I think of as “natural closing.” This light-handed approach also increases buyer trust, deal profitability and long-term customer relationship value.

Three reasons you shouldn’t focus on B2B software sales closing

1. No one likes being closed

You’re fooling yourself if you think buyers don’t know what you’re doing when you run a closing technique on them. They know, and they aren’t happy about it.

Think about your own buyer experiences: Have you ever been on the receiving end of a closing technique? If so, I’ll bet you didn’t enjoy the feeling you were being manipulated. Maybe you were thinking, “Is this really the best for me, or is this person just trying to make month-end numbers?”

Rule of thumb: People hate to be sold but love to buy. A focus on closing doesn’t add to the enjoyment of the buying experience. There are other ways to do this while adding momentum to the sales cycle (see next point).

2. An obsession with closing distracts from your real work

Great software salespeople know their job is to help prospects understand their options and make well-informed decisions. This works best as a collaborative process.

I think of the sales process as a journey of mutual discovery during which buyer and seller explore the landscape of possibilities together. At the start, with less information available, they range widely. Progressively, with feedback from the buyer and added information from the seller, they narrow the range to where the buyer really wants to be (thereby minimizing number of quotes). The close emerges as a natural conclusion of this process.

Throughout the journey, there’s discussion of how the buyer organization will extract business value from using the software. But there’s also an open dialog about price. Don’t try to obscure price until late in the game. Not talking about price adds anxiety for both parties, which can build throughout the sales process.

Early on and throughout the interaction, buyers need to know the general buckets of dollars associated with the capabilities they’re considering. When you get to the final proposal, there should be no surprises—especially on price. The ultimate deal killer is when a prospect who expected a price of around $X receives a proposal for $2X.

3. Closing techniques have risks—you don’t need to take

Because most buyers know what you’re doing, trying too hard to close can be risky. As buyer trust drops and discomfort rises, you may see high-pressure tactics coming back at you from their side of the deal. Buyers may maneuver for a bigger discount or other incentives. They might reduce their at-risk dollars by limiting their initial purchase to a subset of the software capabilities they want. Often such friction is in direct response to seller behavior and doesn’t have to happen.

Three essentials for natural software sales closes

1. Optimal pricing model as part of an integrated monetization strategy

Optimal pricing models are systematic and programmatic, using data and formulas to remove ambiguity. They are anchored in integrated monetization strategies, which include the right licensing metric and packaging supporting how different classes of customers use and derive value from the software in similar ways. The pricing model covers edge and corner cases, works for large and small organizations, addresses a full range of ordering scenarios and continues to make sense to customers as they expand deployments.

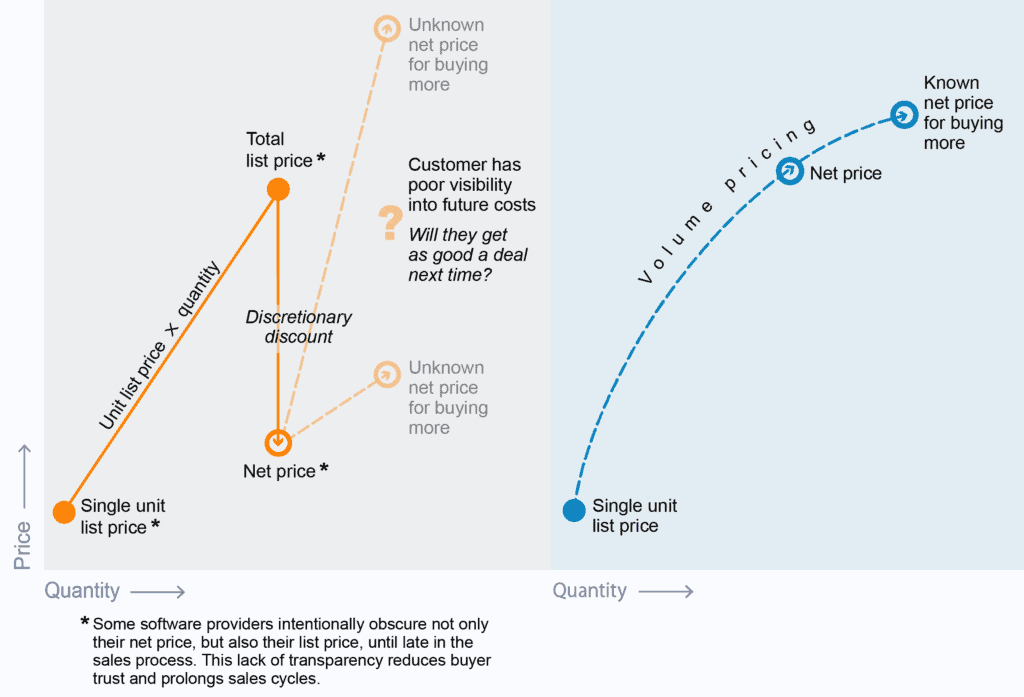

An essential component of an optimal pricing model is a structured incentive framework. It makes clear that discounts aren’t given but earned as customers buy more—and that every buyer has the same opportunities to earn these advantages.

We call this Market Fairness Pricing. It doesn’t mean you charge everyone the same price. It does mean you use a data-driven, systematic, proven method of extracting your fair share of net price while ensuring buyers spending the same amount receive the same discounts.

2. Pricing fluency

Pricing fluency is a sales concept, similar to situational fluency but specific to the economics of the deal. It’s the ability to go beyond the usual focus on price and ROI. Fluent salespeople can quickly and clearly explain how your pricing model works, show how it scales, come up with relevant examples and help buyers explore a range of options, narrowing it down to the best choices. Basically, what they’re doing is pricing several use cases on the fly, building trust and transparency with the buyer along the way. Closing is a natural outcome of this process.

3. Pricing fluency sales enablement too

A new type of sales enablement tool helps salespeople achieve pricing fluency. It provides what you might think of as a “fluency overlay,” displaying a breakdown of deal economics, such as TCO, discount dollars, discount percentage and per-unit pricing. Our LevelSetter provides these capabilities along with sample language to help salespeople talk prospects through their options in a manner that emphasizes usage-derived value and earned discounts.

During call preparation, salespeople use LevelSetter to rapidly configure a starter range of deal options. During the call, they can quickly add information or change a parameter as new information and requests arise. LevelSetter generates alternative deal structures and charts comparisons to help tighten up the range of options.

Throughout the sales process, LevelSetter captures detailed data on every deal closed and explored. This substantial source of customer and market intelligence is a goldmine for sales improvement, demand elasticity analysis and understanding changing customer mix.

LevelSetter also provides insights to future optimization opportunities for packaging and pricing. Put another way, with this tool, you see willingness to pay in real time and in relationship to your integrated monetization strategy.

How to overcome the biggest causes of B2B deal closing delays

1. Buyers aren’t sure how their needs fit into your software packaging/pricing landscape

Explore the landscape with them in a transparent, collaborative way. Ask questions, provide examples of how other customers are deriving value from similar usage and show what their discount dollars, discount percent, per unit price, and so on would be under different scenarios.

2. Buyers don’t understand how your pricing scales and if it will work for them in the future

Expand on net price scenarios to demonstrate how your pricing model scales—simple, reliable and predictable. For instance, “We’ve been talking about what your net prices would be at this range of commitment, but just for comparison, here’s what they would be at double that volume, and at two-thirds of it.”

Use comparisons to help buyers understand how their value and cost would change if they later added capacity, expanded usage, increased consumption or transaction volume, or bought additional packages. Some of our customers are embedding LevelSetter into their systems so their customers on usage-based pricing can forecast their costs and adjust as needed.

A rule of thumb: In sales, what I don’t tell you about upfront, you aren’t going to buy later. Trying to make sense of competitive offerings, customers tend to put software providers in a small box. So if you don’t tour them through the diverse set of configuration and purchase options relevant to their needs and business situation, you’re not lining yourself up for future sales. The touring process sets the stage for relationship expansion.

3. Buyers don’t trust you to treat them fairly

Right up front, state your pricing philosophy: Customers who purchase the same software packages at the same quantity pay the same price. And everyone has the same opportunity to earn discounts by buying more.

Reinforce that commitment during the sales process as you tour them across your pricing landscape. And if you have a deal desk, make sure entry criteria are clearly defined along with consistent rules for how buyers qualify for additional incentives (such as by committing to an extended contract or making a year’s payment in advance). That way salespeople can easily tour their potentially qualified prospects through those possibilities too.

Prove fairness at closing, if necessary, by offering to show them anonymized copies of transactions on your last five similar deals. While this suggestion might be challenging to implement on day 1, the sooner you can say you’re fair and show you’re fair with confidence, the sooner you’ll accelerate your sales production.

To find out more about the interplay between pricing and closing, keep reading this blog, or contact me: chrismele@softwarepricing.com.