Most B2B SaaS companies price their products incorrectly. They rely on cost-plus formulas or they copy competitors instead of focusing on what customers actually pay for: results. A value-based pricing strategy changes this by tying your prices directly to the business outcomes your software creates.

When markets become tough and competition intensifies, companies that employ value-based pricing tend to outperform those relying on traditional methods. The reason is that customers pay more for solutions that solve real problems and deliver measurable ROI.

This guide shares tips for using a value-based pricing approach that drives consistent revenue growth. You’ll learn to identify what customers truly value, connect pricing to measurable outcomes, and utilize data to continuously optimize prices. Whether you’re at $10M ARR or planning an exit, pricing based on delivered value turns revenue generation from guesswork into a predictable and systematic process.

What Is Value-Based Pricing?

Value-based pricing strategy sets prices based on the perceived worth your software delivers to customers rather than production costs or competitor rates. This approach focuses on the economic value, time savings, and business outcomes your solution creates for users.

The foundation rests on three essential elements: customer value perception, outcome measurement, and ongoing validation through customer data. Your pricing reflects how much customers save, earn, or improve their operations through your software. Understanding this requires a deep understanding of customer workflows, pain points, and success metrics.

Traditional pricing methods often miss the mark because they ignore what customers actually value. With a value-based pricing strategy, you need continuous customer research and feedback loops. You must gather quantifiable proof of the results your software generates, whether that is through productivity gains, cost reductions, or revenue increases. This data is your strongest asset when justifying your pricing decisions.

| Value-based pricing aligns your revenue directly with the business impact you create for customers, making price increases easier to justify and defend. |

How Value-Based Pricing Differs from Cost-Plus Pricing

Cost-plus pricing adds a markup to production expenses, creating a ceiling on profitability. It assumes that customers will pay a predetermined price without considering market demand or competition.

A value-based pricing strategy flips this logic completely. When your software saves a customer $100,000 annually, you can charge $30,000 instead of limiting yourself to cost plus 20%. This approach captures more value while still delivering significant ROI to customers. The pricing ceiling becomes the customer’s alternative cost or status quo expense, not your internal costs.

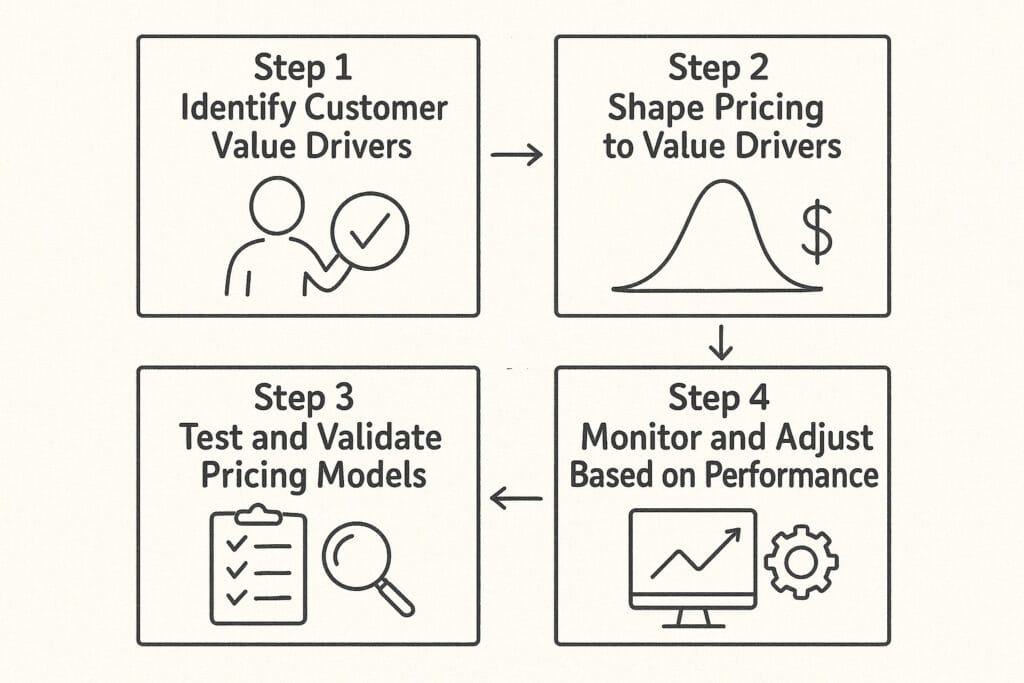

How to Implement Value-Based Pricing in 4 Steps

Shifting from traditional pricing models to a value-based pricing strategy requires a clear roadmap. These four steps give you a framework for approaching value-based pricing in your B2B SaaS company.

Step 1: Identify Customer Value Drivers

Begin by understanding exactly what outcomes your software creates for different customer types. Talk directly with existing customers to learn about their challenges before using your product and the improvements they’ve seen after adoption. Focus on benefits you can measure, like time saved, costs cut, or revenue generated.

Build detailed customer journey maps that show where your software makes the biggest difference. If your CRM shortens sales cycles by 30%, that’s a great benefit. Calculate what that faster deal closure means financially for companies of different sizes and identify the product features as part of your value drivers that enable this benefit. Organize these value drivers into clear documentation that your sales team can use during pricing conversations.

| Successful value-based pricing requires continuous measurement of customer outcomes and regular validation of pricing assumptions through direct customer feedback. |

Step 2: Map Value to Pricing Tiers

Build your pricing tiers around the value drivers you discovered. Create packages that match different customer segments and their specific requirements. Skip feature-based tiers that don’t connect to actual customer value.

Step 3: Test and Validate Pricing Models

Test different pricing approaches with controlled experiments before rolling them out company-wide. Run A/B tests on pricing pages with new prospects while tracking conversion rates and customer responses. You can use cohort analysis to see how various pricing strategies impact customer lifetime value and churn, but it leads to complex, spreadsheet-heavy workflows that are difficult to scale and dependent on a spreadsheet expert, which could become a critical dependency risk.

Start small with a specific market segment or customer group. Have a few sellers and/or account managers test the new pricing in discussions with prospects and renewal customers. Try price increases with existing customers who show high engagement and strong results. Their feedback will give you valuable insights for wider implementation while protecting your main revenue stream from unnecessary risk.

Step 4: Monitor and Adjust Based on Performance

Set up metrics that track both pricing success and customer value achievement. Watch win rates, deal sizes, sales cycle length, and customer satisfaction scores. Monitor how pricing changes affect customer acquisition costs and expansion revenue from existing accounts.

Build systems that connect customer success data with pricing decisions. When customers achieve outstanding results, document these wins to support future price adjustments. Schedule regular pricing reviews alongside product updates and market changes to keep your value-based pricing strategy properly aligned.

Not sure?

Check out how

ARR scaled from ~$20M to $150M in 3 yrs, reaching ~$250M by 2023

Value-Based Pricing vs. Alternative Pricing Models

Each pricing method fits different business situations and market conditions. Here’s how these strategies stack up against each other and when B2B SaaS companies should use each.

Value-Based vs. Cost-Plus Pricing

Cost-plus pricing attracts many businesses because it feels straightforward and safe. You add up your production costs, tack on your desired profit margin, and you’re done. This method makes sense for physical products where you can easily calculate material costs, but it creates problems for software companies where development happens upfront, and serving additional customers costs almost nothing.

A value-based pricing strategy starts from the opposite direction: It begins with what customers actually gain from your software. When your project management tool saves a client $50,000 each year through better productivity, you can confidently charge $15,000 annually, whether your costs are $1,000 or $10,000.

| Value-based pricing removes the artificial ceiling that cost-plus pricing creates, allowing you to capture fair value for the results you deliver. |

Value-Based vs. Competitive Pricing

Competitive pricing means looking at what your competitors charge and setting similar rates. This feels logical, but it often leads to a downward spiral where everyone competes on price instead of results. When all the options cost roughly the same, customers pick based on features or personal relationships rather than the actual business impact. Nobody wins, and the actual value delivered is diluted.

Value-based pricing frees you from this trap because it focuses on the specific outcomes your software delivers. If your solution produces better results than the alternatives, you can price accordingly. Your competitors become useful reference points without forcing you to match their rates, especially when your software delivers superior performance.

When to Choose Each Pricing Strategy

The right pricing approach depends on where you stand in the market, how well you understand your customers, and what you’re trying to achieve. Here’s a practical way to make this decision:

- Assess customer outcome visibility: When you can easily measure and explain the value your software creates (like time saved, costs cut, or revenue generated), value-based pricing is a strong option.

- Evaluate market maturity: Newer markets without established pricing norms work well for value-based approaches, while established markets with set expectations might require you to also consider competitive factors, however, this doesn’t equate to price equivalency, rather finding your unique value proposition is a sea of competitors

- Review competitive differentiation: Strong differentiation supports value-based pricing, while solutions that look similar to those of competitors may require competitive or cost-plus approaches at first.

- Consider sales cycle complexity: Value-based pricing usually requires longer sales conversations to establish value, which fits enterprise deals better than quick, simple transactional purchases.

Technology-Driven Value-Based Pricing Implementation

Technology-driven approaches to your value-based pricing strategy make real-time adjustments possible, enable continuous testing, and support data-backed decisions that directly boost revenue growth.

Real-Time Data Integration for Pricing Decisions

Connecting your pricing strategy to live customer data changes everything about how you make pricing decisions. Rather than depending on outdated customer surveys, offline spreadsheets, or annual reviews, you can monitor actual usage patterns, feature adoption rates with software like Pendo or MixPanel, and customer success metrics using Gainsight as they unfold. Using software like Gong to record and analyze sales calls can help you capture competitor identification, hear reactions to pricing, packaging, and understand problems in the customers’ voice, while also providing the ability to coach reps on how they position value. These tactics make a direct connection between real performance and pricing, giving you the confidence to adjust rates based on demonstrated value delivery.

Integration with CRM systems, usage analytics, and customer success platforms builds a complete view of value creation. When customers consistently exceed usage thresholds or achieve specific outcomes, your pricing system can automatically identify opportunities for upgrades or renewals at higher rates. This approach eliminates guesswork from pricing conversations and equips sales teams with concrete evidence to support value-based proposals.

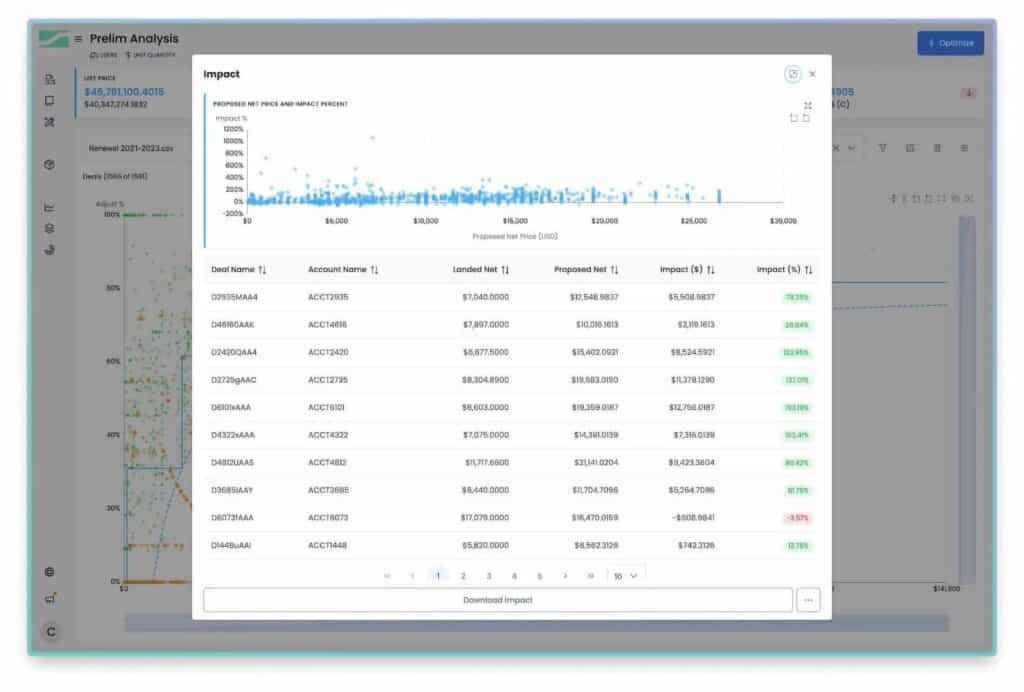

Simulation and Testing Capabilities

Advanced pricing platforms allow you to model different scenarios before implementing changes. You can simulate how price adjustments affect customer segments, test new packaging structures, and predict revenue impacts across various market conditions.

Here’s how technology platforms compare to manual processes across key pricing capabilities:

| Capability | Manual Process | LevelSetter Technology Platform |

|---|---|---|

| Scenario Testing | Limited Excel models | Real-time simulation engine |

| Data Integration | Manual data exports | API connections to all systems |

| Update Speed | Weeks to months | Instant deployment |

| Risk Management | Limited visibility | Controlled rollouts |

| Technology platforms enable controlled pricing experiments that manual processes simply cannot support at scale. |

Continuous Monitoring and Optimization

Post-implementation monitoring shows how your value-based pricing strategy performs in actual market conditions. Automated dashboards track key metrics like win rates, deal velocity, discount frequency and percentages, margin capture, and customer satisfaction scores. When patterns emerge that suggest that pricing adjustments are needed, you can respond quickly instead of waiting for the next quarterly review.

LevelSetter demonstrates this technology-driven approach through combining real-time transaction data with machine learning to manage pricing as a living system. Instead of static spreadsheets, it provides a dynamic pricing engine that integrates with existing RevOps tools while offering simulation capabilities and continuous monitoring. The platform’s “Define, Deploy, Defend” framework enables B2B SaaS companies to model complex pricing structures, test monetization hypotheses against real variables, and maintain pricing performance through automated guardrails and real-time analytics. This infrastructure changes monetization from periodic projects into always-on revenue optimization.

Ready to implement technology-driven value-based pricing that scales with your business? Book A Demo to see how LevelSetter can transform your pricing strategy into a competitive advantage.

FAQs

How long does it typically take to transition from cost-plus to a value-based pricing strategy?

Most B2B SaaS companies need 3-6 months to fully implement value-based pricing, including customer research, pricing model development, and team training. The timeline depends on your existing customer data quality, the complexity of your value propositions, and the number of products and SKUs.

What’s the biggest mistake companies make when implementing value-based pricing?

The most common error is failing to gather concrete evidence of customer outcomes before setting prices. Without documented proof of value, such as time savings, cost reductions, or revenue increases, sales teams struggle to justify higher prices during negotiations.

Can small SaaS startups use value-based pricing strategy effectively?

Yes, startups often have an advantage with value-based pricing because they can build customer relationships from the ground up around outcomes rather than features. Early-stage companies should focus on measuring and documenting customer success stories to support their pricing decisions. SPP can heklp startups with first launch, introducing new products, or packaging and pricing updates as their product capabilities grow.

How do you handle customers who resist price increases under value-based pricing?

Resistance usually occurs when the solution doesn’t solve the problem at hand or the buyer is overly budget-conscious vs. finding the best fit solution. Present clear data showing the specific business outcomes and ROI they’ve achieved using your software. When customers see documented evidence of value delivery that exceeds the price increase, resistance typically decreases significantly.

What metrics should I track to measure the success of my value-based pricing implementation?

Monitor win/loss rates, average deal size, discounting, sales cycle length, customer lifetime value, and churn rates as primary indicators. Additionally, track customer satisfaction scores and renewal rates to ensure that pricing changes don’t negatively impact relationships.