Enterprise SaaS pricing and packaging require different architectures than standard subscription models do. You can’t simply add higher price tiers and expect enterprise customers to convert. These buyers need pricing structures that handle complex procurement processes, multi-year agreements, and custom integrations worth millions.

Most B2B software companies still use outdated pricing and packaging approaches that either undervalue their products or create friction during sales cycles. The result? Lost revenue and extended negotiation periods that drain resources.

Enterprise SaaS pricing separates scaling companies from those stuck in endless deal discussions. This guide covers proven SaaS enterprise pricing models that protect margins while speeding up sales velocity. You’ll see how successful software companies use data-driven systems to optimize their monetization strategies instead of relying on static spreadsheet calculations.

Understanding Enterprise SaaS Pricing Fundamentals

Enterprise SaaS pricing and packaging follow completely different rules than what you’d use for smaller business customers. When you’re selling to large organizations, you’re working with buyers who expect negotiated terms, long-term agreements, and pricing models that match their specific operational needs and scale requirements.

What Makes Enterprise SaaS Pricing Different

Enterprise customers approach purchasing decisions differently than small and mid-market buyers. They operate through formal procurement processes, require legal team reviews, and need budget approvals that can take several months to complete. Your enterprise SaaS pricing strategy and packaging architecture must work within these constraints while still protecting your profit margins.

Enterprise sales involve multiple decision-makers across different departments, each with their own priorities. Your end users might champion your solution, but the CFO will analyze total ownership costs while IT security teams focus on compliance and data protection. Your packaging structure needs to address what each group cares about without creating confusion during deal negotiations.

Volume commitments drive most enterprise pricing conversations. Rather than starting with entry-level packages like smaller customers do, enterprise buyers typically negotiate based on expected usage across hundreds or thousands of users. This opens doors to larger deal sizes, but your pricing SaaS enterprise software approach needs to scale appropriately with volume.

Key Characteristics of Enterprise Pricing Models

The most effective SaaS enterprise pricing models and packaging strategies share common traits that make them work for both buyers and sellers. They present clear value propositions that justify higher price points through measurable business outcomes. Custom packaging lets enterprises choose features that align with their actual needs instead of paying for capabilities they won’t use.

Enterprise packaging naturally includes service level agreements, dedicated support teams, and hands-on implementation help. These aren’t optional extras that you tack on later; they’re core components that enterprise buyers consider essential parts of their investment.

| Enterprise buyers evaluate software purchases based on ROI calculations, risk mitigation, and long-term strategic value rather than simple feature comparisons. |

The Economic Impact of Strategic Pricing

Well-executed SaaS enterprise pricing and packaging models deliver benefits that extend far beyond immediate revenue increases. Smart pricing and packaging design shortens sales cycles by removing ambiguity from negotiations. According to a CIO Dive article a few short months ago, technology executives are focusing on cost management and postponing discretionary projects, which makes clear value propositions more critical than ever before.

Your pricing and packaging architecture influences your entire revenue operation’s performance. Poorly designed pricing structures create negotiation bottlenecks, forces sales teams into time-consuming custom deal structures, and erodes margins through excessive discounting. Strategic pricing and packaging eliminates these friction points while enabling more predictable revenue growth patterns.

Comparison of Enterprise SaaS Pricing Models

Choosing the right enterprise SaaS pricing model and packaging approach can make or break your deal velocity and customer acquisition strategy. Whether you go with usage-based, consumption-based, tiered, or hybrid approaches, each model shapes how prospects perceive value and compare your solution to competitors. The pricing model and packaging structure you select affects everything from initial sales conversations to long-term customer expansion opportunities.

Usage-Based and Consumption-Based Pricing for Enterprise Scale

Usage-based pricing, where customers are charged based on actual usage of the product or service, creates a natural alignment between what customers pay and the value they receive. According to Cobloom’s SaaS pricing guide, this pricing model eliminates large upfront investments that often stall enterprise deals, allowing pricing to scale directly with the business value your solution delivers.

Enterprise buyers find this model appealing because they can test your solution with minimal financial risk. They start with limited usage, prove the value internally, then expand based on actual results. This creates organic expansion revenue as their usage grows, but you’ll need crystal-clear definitions of what constitutes billable usage from day one.

The biggest challenges come with revenue forecasting and billing complexity across large organizations with multiple departments. You need strong analytics capabilities to track usage patterns accurately and help customers understand their consumption while maintaining healthy margins on your end.

Tiered Packaging and Custom Enterprise Plans

Most enterprise packaging strategies rely on tiered editions (different product levels with increasing features and pricing) because finance teams need predictable costs for annual budgets. The most effective approach typically involves three to four tiers with distinct feature sets and volume-based pricing (where the price per unit decreases as quantity purchased increases) that encourages larger commitments upfront.

Custom enterprise packages become essential when your standard tiers don’t address unique organizational requirements. These negotiations often center on specific compliance needs, custom integrations, or feature combinations that justify premium pricing. Your custom pricing should still follow consistent internal logic to avoid confusion and protect margins.

| Enterprise buyers evaluate packaging tiers based on feature necessity rather than price sensitivity, making clear tier differentiation more important than competitive pricing. |

The goal is to design tiers that naturally guide customers toward higher-value packages without making lower tiers feel unnecessarily limited. Each tier should offer genuine value increases rather than artificial restrictions designed to push upgrades.

Hybrid Pricing Approaches

SaaS enterprise pricing models increasingly combine base subscription fees with usage components, giving you revenue predictability while capturing upside from heavy users. This works especially well for platforms where core functionality justifies a fixed fee but variable usage creates additional value.

Common examples include base platform access combined with transaction-based fees (charging by non-user-based value metrics associated with completing activities), or core per-user licenses plus charges for storage or API calls. The subscription component provides steady revenue while usage elements ensure that heavy users pay proportionally without penalizing lighter customers.

Enterprise Pricing Model Comparison

Here’s how the main pricing SaaS enterprise software approaches compare across key business factors.

| Pricing Model | Best For | Revenue Predictability |

|---|---|---|

| Usage-Based | Variable consumption patterns | Low |

| Tiered | Standardized enterprise needs | High |

| Hybrid | Mixed usage scenarios | Medium |

Building Scalable Enterprise SaaS Pricing Systems

Building effective enterprise SaaS pricing and packaging goes far beyond picking numbers and hoping they stick. You’re creating the foundation that handles complex negotiations, connects with your revenue operations, and grows alongside your business. Most B2B software companies hit walls because they treat pricing like a static price list rather than a flexible system that adapts to how enterprises actually buy software.

Pricing and Packaging SaaS Enterprise Software: A Step-by-Step Framework

Successful SaaS enterprise pricing models and packaging strategies start with understanding exactly how your product creates value and how customers measure that value in their own terms. Enterprise buyers don’t make purchase decisions based on features alone, rather needing to show clear ROI and justify budget allocation to multiple stakeholders.

Here’s how to build pricing SaaS enterprise software that actually works in real sales situations:

- Map value metrics to customer outcomes: Find the direct connections between your product capabilities and the results customers care most about, like cost reduction, productivity gains, or revenue increases.

- Analyze deal patterns from existing customers: Look at your historical pricing data to understand how enterprise buyers really use your product compared to what they initially planned.

- Design packaging tiers around decision-maker priorities: Create packages that speak to different people in the buying process—budget efficiency for CFOs, complete functionality for users, security compliance for IT teams, etc.

- Build negotiation guardrails: Set clear minimum margins and create approval workflows that prevent pricing from getting eroded during long sales cycles.

- Test pricing models and packaging with prospect segments: Run controlled tests with different types of enterprise customers before rolling out changes company-wide.

This framework helps you create pricing systems that protect your margins while making it easier for prospects to say “yes” through clearer value propositions.

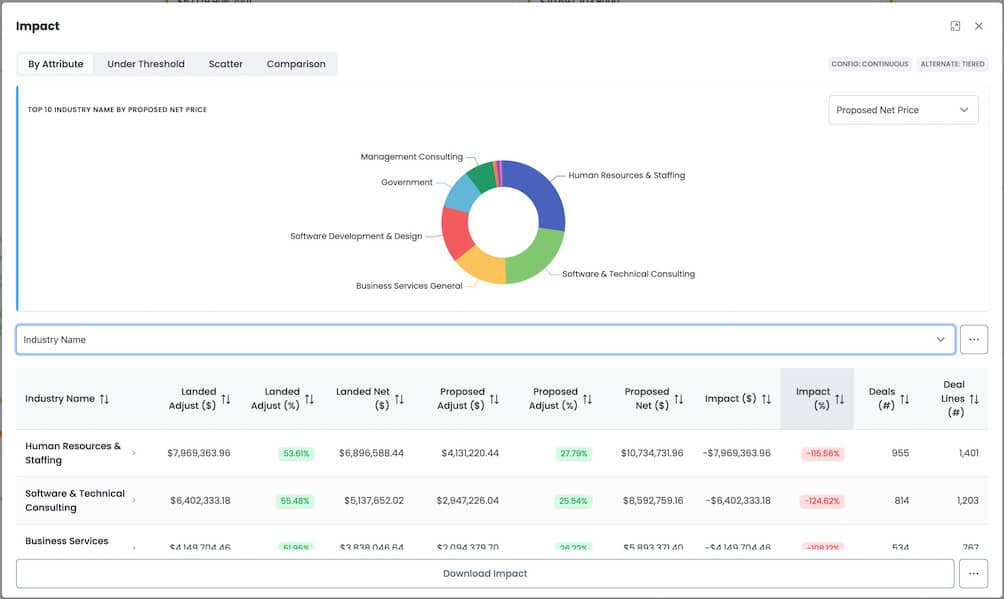

Stop Guessing, Model Your Pricing

See the impacts of proposed changes and reduce negative customer sentiment before you rollout new software pricing.

Integration with Sales and Operations

Enterprise SaaS pricing and packaging models break down when they’re disconnected from how your team actually sells and operates. Your pricing strategy needs to work seamlessly with your CRM, billing systems, and approval processes to avoid errors and keep the customer experience consistent.

| Pricing and packaging systems that integrate with sales operations reduce deal cycle times by eliminating manual quote generation and approval bottlenecks that slow enterprise negotiations. |

Your sales team needs instant access to pricing rules, discount limits (including discount waterfalls—predefined discounts based on tranches, steps, dollars spent, or unit volume), and competitive positioning information during customer calls. When pricing information sits in spreadsheets or requires manual calculations, you create delays that give competitors an opening during active evaluations. Integration also means that your finance team can forecast revenue based on actual deal patterns instead of theoretical models.

Managing Complex Deal Negotiations

Enterprise deals involve multiple decision-makers, custom requirements, and pricing conversations that can stretch across months. According to Airfocus, SaaS companies need data-driven decision-making frameworks to extract valuable insights during these complex sales processes.

Smart SaaS enterprise pricing models expect negotiation scenarios and give you clear ways to handle custom requests without breaking your pricing strategy. This means setting up approval processes for non-standard deals, creating templates for common customization requests, and maintaining visibility into how negotiations affect your overall pricing approach.

The best approach gives your sales team flexibility within set boundaries while keeping central oversight of pricing decisions that could impact future deals. This balance protects your margins while enabling the customization that enterprise buyers expect during their procurement process.

Technology-Driven Pricing Optimization

Spreadsheet-based pricing methods break down when you’re managing complex enterprise deals at scale. The disconnect between static pricing models and actual sales situations creates delays that slow down negotiations and hurt your profit margins. Software companies still using manual pricing calculations often lose ground to competitors who’ve adopted data-driven optimization systems.

Real-Time Pricing Intelligence and Simulation

Enterprise SaaS pricing models carry major revenue consequences, which makes testing pricing changes before rolling them out across your customer base essential. Simulation tools let you model different pricing models, price points, packages and other scenarios using historical and real-time deal data to understand how adjustments might impact win rates, deal sizes, and customer retention.

| Real-time pricing eliminates the guesswork from enterprise negotiations by providing sales teams with data-backed pricing recommendations based on comparable deals and customer usage patterns. |

Pricing systems monitor competitor actions, market shifts, and customer feedback to help you adjust your SaaS enterprise pricing before you lose deals to better-positioned alternatives. This responsiveness becomes critical when enterprise buyers evaluate multiple vendors during lengthy decision processes.

Continuous Monetization Platforms

Software Pricing Partners built LevelSetter to solve the problems with traditional pricing methods through continuous optimization features. The platform connects with your existing CRM and billing systems to deliver real-time pricing guidance while maintaining margin protection and discount oversight.

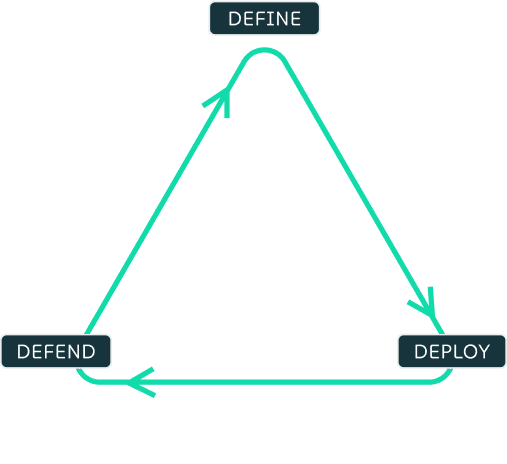

LevelSetter’s Define, Deploy, and Defend framework manages the complete lifecycle of pricing SaaS enterprise software. The Define phase analyzes historical transaction data to inform new pricing structures that align with customer-defined value and match actual customer behavior. Deploy allows controlled testing of new pricing strategies before full implementation. Defend offers ongoing monitoring to identify pricing issues before they hurt revenue performance.

The platform’s simulation engine analyzes deal patterns to demonstrate how pricing changes will affect different customer segments, giving you confidence to optimize prices without risking current revenue streams. Integration features ensure that pricing decisions work smoothly with your sales operations and financial reporting systems.

Ready to move beyond static spreadsheets and implement data-driven pricing optimization for your enterprise sales? Book a Demo to see how LevelSetter can streamline your pricing strategy while protecting margins and accelerating deal velocity.

Conclusion

Successful enterprise SaaS pricing and packaging requires robust systems that manage complex deal negotiations without sacrificing profit margins. Organizations that achieve sustainable growth rely on data-driven platforms rather than manual spreadsheets to refine their SaaS enterprise pricing strategies on an ongoing basis. Your pricing framework needs direct integration with sales operations, must deliver immediate guidance during contract discussions, and must evolve based on real customer usage data instead of hypothetical projections.

The gap between enduring prolonged deal cycles and securing enterprise contracts efficiently hinges on implementing proper pricing infrastructure. When you merge established enterprise SaaS pricing models with technology that forecasts results and tracks performance metrics, you build lasting competitive benefits that grow stronger over time. Begin with examining your existing deal workflows, then develop systems that transform pricing SaaS enterprise software from an obstacle into a revenue driver.

Looking for more on AI Pricing check out our Pricing AI Software blogs.